Center of expertise on nonlinear thermodynamic complex-systemic macro-analysis of human and natural domains

Economic entropy and fractal depth of transactional dynamics

There is some consensus on the absurdity and unhealthy aspects of our current financial system, and on the crisis of the capitalist paradigm of our economic system as a whole.

The rampant growth and concentration of capital allocation and financial engineering are causing all kinds of collateral social and environmental damage, and are suspect of causing severe

instability to the global financial system. The systemic trend towards passive capital allocation is creating a kind of systemic interdependency that is unprecedented.

'The tail has started to wag the dog' is sometimes used as a qualification of the current situation, where unprecedented CB-policies (QE, ZNIRP) after the GFC of 2007/08

are providing even more leverage and liquidity to the financial-economic system, outperforming any organic, healthy business cycles.

One of the most anomalous aspects (I think) is High Frequency Trading. In a previous publication I have provided a qualitative analysis of the emergence of High Frequency Trading, which concluded that it does not only concern a clustering dynamic in the

infrastructural dimension, but that it concerns the unprecedented clustering dynamic in the temporal dimension. That certainly qualifies as an anomaly.

The current advent of Bitcoin and other crypto-currencies is often presented as an antithesis to this failing fiat monetary system, with a critical aspect addressing the issuance of money by central banks.

But the 'turf-wars' between Bitcoiners and fiatists (joined by DeFi, CeDeFi, CDBC, etc) debating the superiority of its monetary systems are missing the point.

The 'forces' that drive financial capital allocation do not care about the underlying technological infrastructure. It will take any infrastructure available to optimize its dynamics.

From that point of view, the crypto-sphere just adds to the problem at a higher abstraction level, instead of fixing it at the correct level.

Therefore, we need to take a step back, and try to determine the common denominator in both fiat and crypto (and actually the whole economic system).

We need to abstract the qualitative dynamic aspects from the facilitating technological infrastructure.

Economic entropy

I am not going to do econophysics here, but I am going to take a much more abstract approach. Entropy is an unholy term, often misunderstood and conflated within several scientific domains. In essence, it is about a statistical inference on microstates and macrostates. In short: a 'system' can have many 'states'. A state is just any possible 'screenshot' of the system, with its population and its dynamics in a certain position and direction. All the combinatoric possible states of a system are called 'microstates'. The 'macrostate' is just some aggregate property, like 'temperature': there are many microstates of a gas (positions and energy of molecules) with the same temperature. This also holds, for example, for an economy with 'inflation' as macrostate.Some of these aspect display an 'entropic gradient', just like those in thermodynamic systems. This just means that, by statistical inference, it is more likely for a system to occupy a macrostate that has many microstates than a macrostate with not that many microstates. So, over time, the system will show a trajectory towards the macrostate that can be produced by the largest set of associated microstates. Energy dissipation is the trivial example. In general, this dissipative quality leads to an equilibrium, some dynamical balance.

Is there a 'dissipative' dynamic in an economy as well? There is some severe economic heterodoxy that states that an economy does NOT have an equilibrial dynamic. After all, the economic system has lots of extrinsic forces at play, and has lots of nonlinear dependencies, just like natural ecosystems.

Well, just like entropy is an unholy term, so is 'equilibrium'. It mainly depends on your ZOOM-LEVEL and the subdynamic you zoom onto, that allows you to qualify it at equilibrial or not. It really does not matter. What matters is what the statistical inference applies to, because that is what 'explains' the dynamic.

Settlement of supply and demand

The relevant candidate for statistical inference in an economic system is settlement of supply and demand. An economic system always shows a trajectory towards a higher ratio of settlement of supply and demand, given an initial state (of supply and demand).After all: a macrostate of 'high settlement-ratio' has more combinatoric 'solutions' (microstates) than a macrostate of 'low settlement-ratio'. This is because there is no difference between the state 'X has not settled with Y' and 'X has not settled with Z'.

The principle of maximum entropy production

In another publication, I have shown that a system does not only increases entropy, but it increases entropy AS FAST AS POSSIBLE!Applied to the economy, this means that it will not only just settle supply and demand, but it will settle it AS FAST AS POSSIBLE.

I would like to stress the importance of this aspect, because it means that, as we add infrastructure for supply and demand to settle on, the system will flood this infrastructure with settlement-dynamics, by means of least resistance, as quickly as possible, as long as it is fed with supply-and-demand.

With one last aspect we can finally connect the dots, concerning what is actually going on in our economy, on a fundamental level.

Fractal depth of transactional dynamics

We all understand why a supermarket is economically viable. It provides for easier settlement of supply-and-demand dynamics between customers and suppliers.The logistic infrastructure has become so efficient in many dimensions, that it is a path of lower resistance.

There can even emerge clustering dynamics between these clustering dynamics. Think of travel-booking agencies (already a level of clustering dynamics) that now cluster their own dynamics (i.e. at a deeper level) over IT solution-providers such as Expedia. The IT-infrastructure provides a path of even lower resistance for a significant part of the transactions.

It is an extra layer of settlement between the primary economic origins of supply and demand.

This can be seen within the financial sector as well, to a much higher level: all derivatives, from CDO's to ETF's and trading platforms up to HFTs etc., all provide 'liquidity' to the economic system.

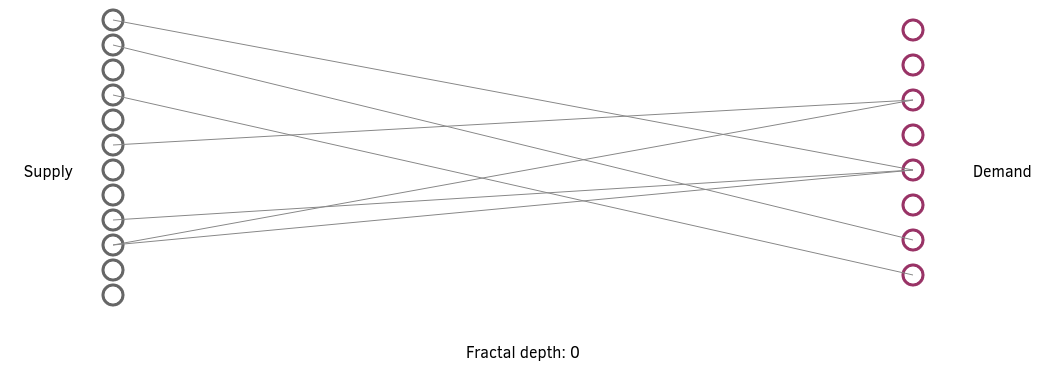

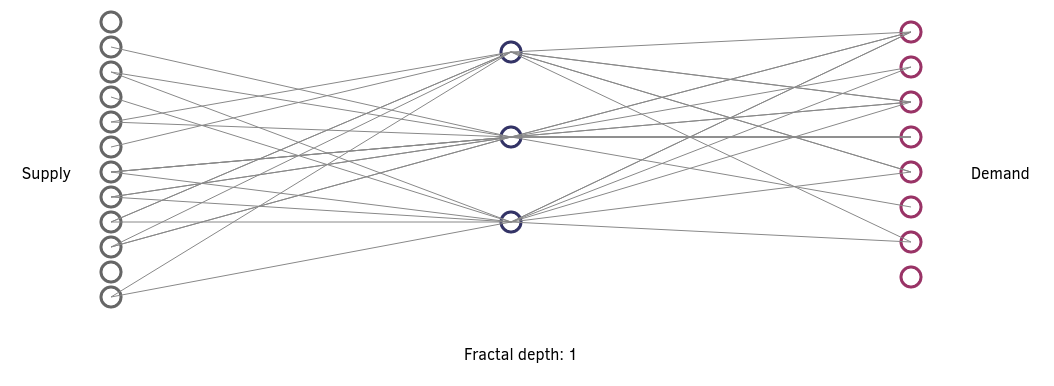

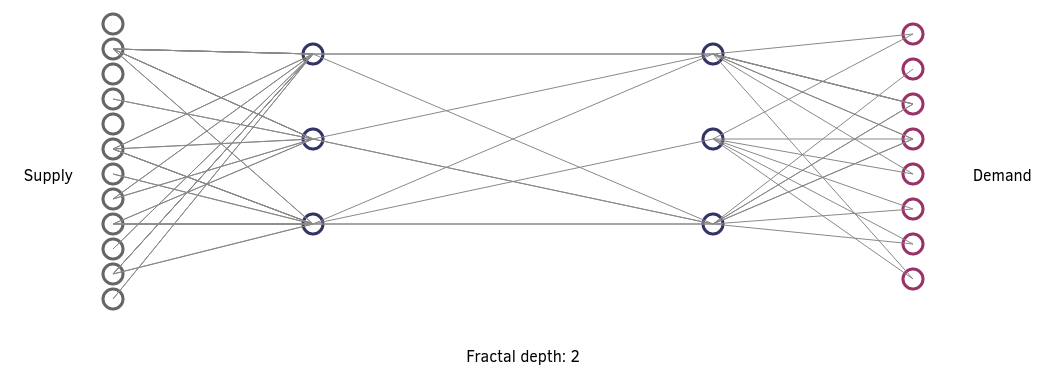

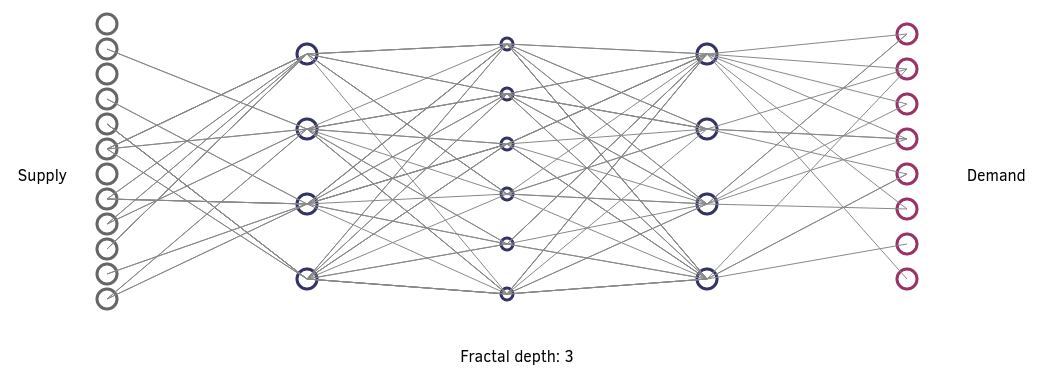

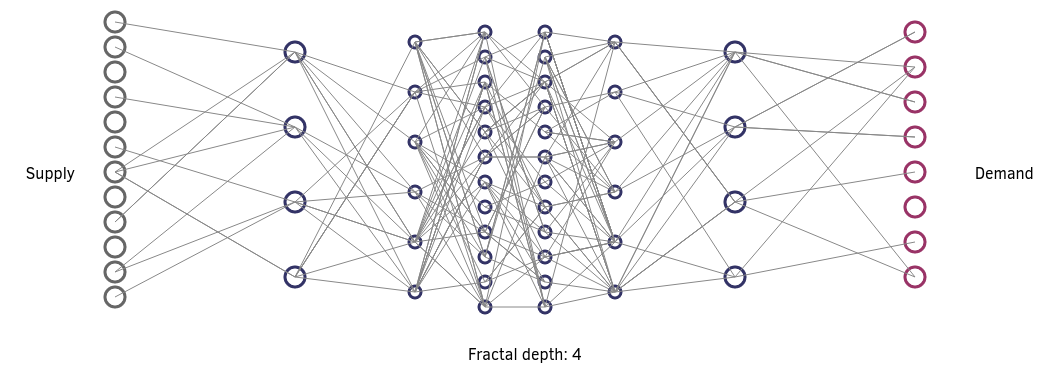

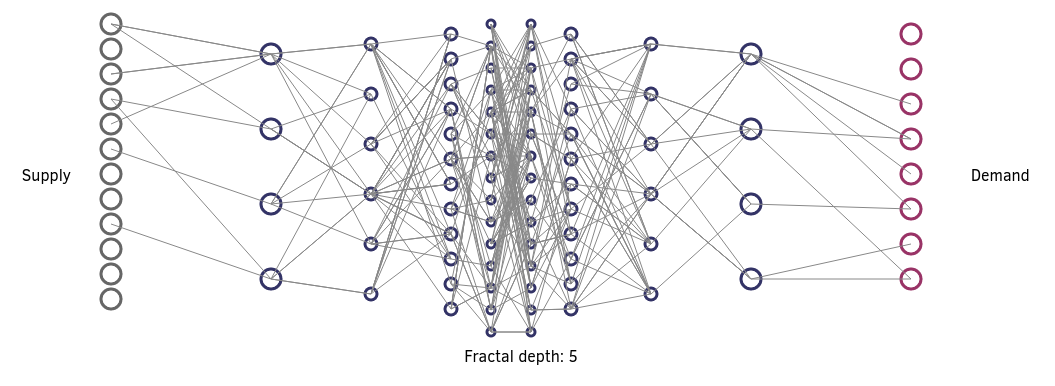

This ever-increasing level of 'intermediacy' between existing supply and demand can best be classified as fractality, which is clearly seen in the following graphs. They range from 'direct' settlement between primary supply and demand to a fractal depth of 5, a 'hierarchy' if you will.

This is obviously highly simplified. At some point the depth is not a discrete quantity anymore, and the topology becomes much more intricate. But the 'metric' of 'fractal depth' can clearly be recognized from these graphs. A high fractal depth means that transactions go over more intermediate 'layers' of settlement. In fact, in more networked topologies the settlement of 'primary' supply and demand can result in all kinds of circular, nonlinear, turbulent and even chaotic dynamics.

Connecting the dots

From this point of view, we can now 'diagnose' the fiat system of suffering from a huge increase of fractal depth, where lots of the settlement in the system does not actually settle 'primary' supply and demand anymore. And the crypto IT-infrastructure IS JUST ANOTHER FRACTAL LAYER in the existing network-topology of settlement. This way, we have abstracted dynamics from the underlying technological infrastructure.Given this metric, financially engineered derivatives, synthetic products, 'liquidity-providers', 'market-makers' and even crypto are all just providing extra layers in fractal depth of transactional settlement.

The crisis of our financial system

Now we can provide an actual 'diagnostic' of the crisis of capitalism, of our financial system. It is the disproportion of fractal depth towards primary economic supply and demand.There is more transactional dynamics going in at fractal depth than in primary settlement. And although this dynamic represents the current path of least resistance, it does not mean that it takes the least amount of resources. Next to the primary supply and demand, a lot of synthetic (virtual) supply and demand is injected into the system in the whole range of fractal depth. So, in aggregate it takes much more resources for settlement.

This allows for a reframing of many narratives: QE is the massive injection of synthetic supply and demand at a certain fractal depth; HFT is both the insertion of a settlement layer at an extremely deep fractal level, and injection of synthetic supply and demand at that level; crypto is the insertion of a settlement layer at a very deep fractal level; etc. The real economy, however, is only served by settlement of primary economic supply and demand, not by deep settlement of synthetic supply and demand, nor by a huge increase of fractal depth.

This also explains why the ESG-initiatives are failing, and why 'circular' initiatives are failing. Conscious greenwashing is not the cause, it is a symptom of the dynamic that belongs to an infrastructure and dynamic with this fractal depth.

A fractal abyss

This reframes the solution to an incredibly simple narrative: reduce fractal depth of the transactional infrastructure, and stop injecting synthetic supply and demand at fractal depth.We should not fear 'centrality' or 'fiat', or 'QE' or 'synthetic products': we should only fear the potential depth of the fractal abyss of transactionality.